Decentralized finance, or DeFi, is revolutionizing the financial landscape by leveraging the power of blockchain technology. This cutting-edge approach disrupts traditional financial systems by enabling peer-to-peer transactions without the need for intermediaries like banks.

DeFi applications, known as copyright, offer a range of services, including lending, borrowing, trading, and yield farming. These distributed platforms operate on smart contracts, which are self-executing agreements written in code and stored on the blockchain.

The transparency of blockchain technology ensures that all transactions are recorded and verifiable, fostering trust and accountability. DeFi's open-source nature allows for collaboration and continuous improvement by a global community of developers and users.

As DeFi continues to evolve, it holds the potential to enable individuals with greater financial independence. By removing barriers to entry and providing access to economic services for all, DeFi is shaping a more inclusive and equitable future.

Automated copyright Trading

The copyright landscape is a dynamic and volatile realm, demanding tactical approaches for successful navigation. Enter AI-powered trading, utilizing the power of artificial intelligence to interpret market trends and execute sophisticated trades with unparalleled speed and accuracy.

These intelligent systems can identify patterns, predict price fluctuations, and mitigate risk, potentially offering traders a significant edge in this volatile market.

- Despite this, the integration of AI into copyright trading presents both possibilities.

- Traders must meticulously assess the efficacy of AI-powered platforms and comprehend the underlying algorithms.

Ultimately, successful AI-powered copyright trading necessitates a blend of technical expertise, market knowledge, and a calculated approach to risk management.

copyright Assets: A New Era for Investment

The landscape of finance is undergoing a significant transformation as digital assets emerge as a lucrative investment option. Traders are increasingly drawn to the promise of these innovative assets, seeking to maximize on their dynamic nature. From Dogecoin to DAOs protocols, the range of digital assets is evolving at an astonishing pace, providing both challenges and benefits.

Traditional investment strategies are being redefined as the digital asset sector matures, necessitating a change in investor outlook. Exploring this dynamic landscape requires a deep grasp of the underlying principles, as get more info well as a willingness to adjust to its unpredictable evolution.

Securing the Future: Blockchain Technology and copyright and

As technology evolves at a rapid pace, emerging innovations like blockchain solutions are poised to revolutionize various industries. copyright, fundamentally tied to blockchain, presents a unique approach to transactions. P2P in nature, these systems offer enhanced security, transparency, and agility. While challenges remain regarding scalability, the potential benefits of blockchain and copyright are undeniable, paving the way for a more robust future.

The Symbiosis of AI and Finance: Transforming Digital Markets

The financial sector embracing a seismic shift as Artificial Intelligence (AI) emerges as a transformative force. This unprecedented synergy of AI and finance is revolutionizing digital markets, propelling new opportunities and redefining traditional paradigms.

Harnessing the power of machine learning, AI algorithms can analyze vast datasets with remarkable speed and accuracy, identifying hidden patterns and trends that were previously inaccessible to human analysts.

- This enhanced understanding empowers financial institutions to make more informed decisions, enhancing operations and providing personalized customer experiences.

- Moreover, AI-powered chatbots and virtual assistants are transforming customer service in the financial sector, providing 24/7 support and streamlining routine tasks.

Therefore, the symbiosis of AI and finance is poised to reshape digital markets, accelerating innovation, increasing efficiency, and facilitating a more inclusive and accessible financial system for all.

Exploring Decentralization: copyright and its Global Reach

copyright has emerged as a revolutionary force in the financial world, challenging traditional systems. At its core, copyright is built upon a technology known as blockchain, which enables secure and transparent transfers without the need for a central authority. This autonomous nature of copyright has far-reaching implications across various sectors, from finance and trade to governance and innovation.

- Furthermore, the adoption of copyright is steadily growing, with an increasing number of individuals, businesses, and even governments exploring its potential.

- Understanding the mechanics of decentralization is crucial for comprehending the true impact of copyright on our world.

Considering its advantages, copyright also presents certain risks. These include price fluctuations and the need for robust oversight to mitigate potential fraud.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Taran Noah Smith Then & Now!

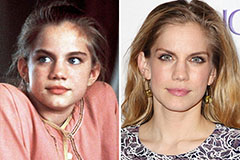

Taran Noah Smith Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now!